Energy Tax Credits for Schools

This page has not been updated since the President signed the latest federal budget reconciliation bill into law on July 4, 2025.

For updates, visit this page.

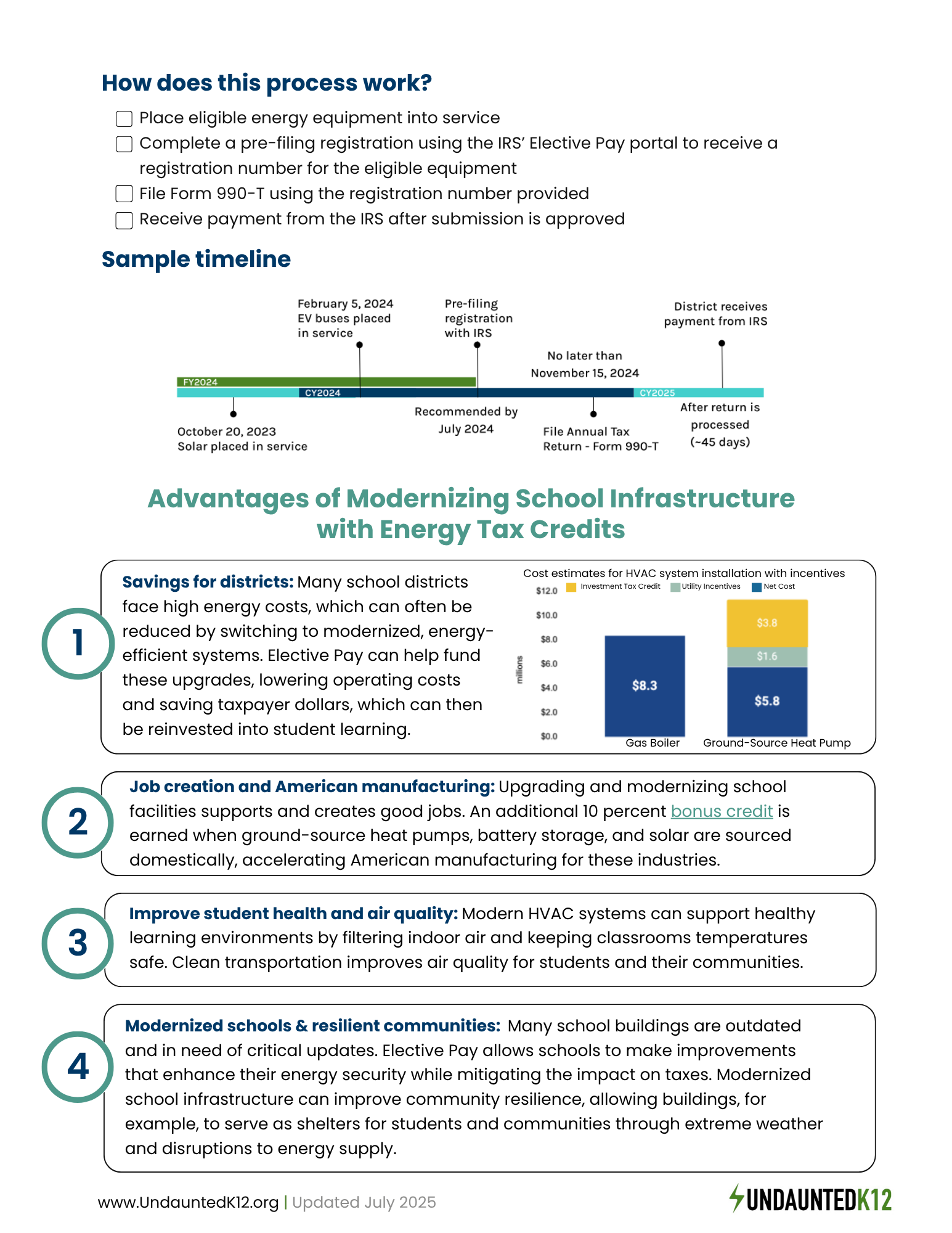

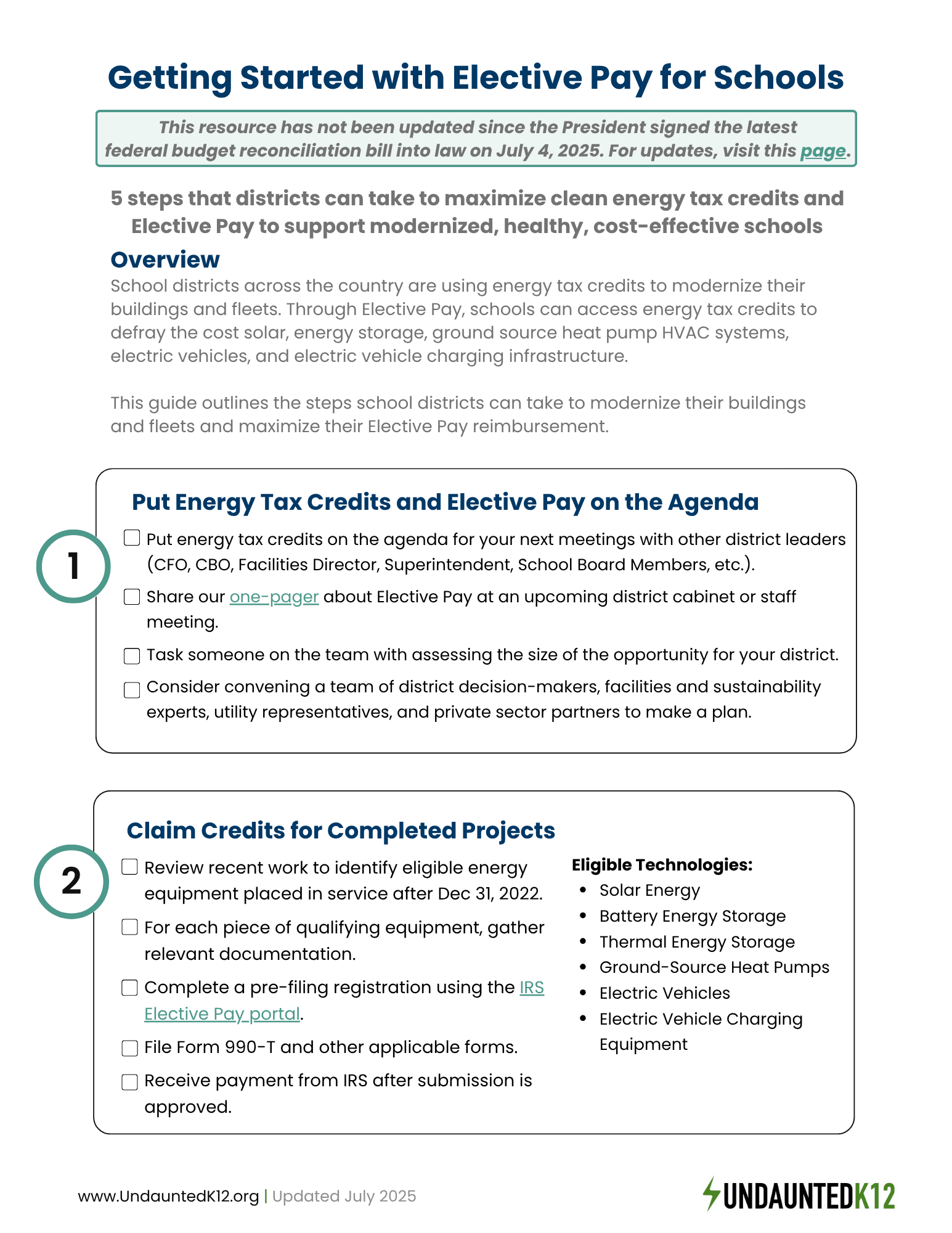

Energy tax credits offer an unprecedented opportunity for schools to modernize their facilities and fleets. These upgrades can reduce operating costs, and create safer, healthier, more resilient learning environments for students and staff.

Schools can now access the full value of tax credits through Elective Pay (also called Direct Pay).

We are working to provide school districts and their partners with the tools and resources they need to make the most of this opportunity.

Do you have a project that may be eligible for energy tax credits through Elective Pay?

Tell us about it here.

Explore resources for district leaders.

Get started with a two-pager on energy tax credits and Elective Pay for district leaders.

Learn how to maximize the opportunity with Making the Most of Energy Tax Credits: Unlocking Federal Investment in your School District.

Watch a webinar to learn from national experts.

Energy Tax Credits for Schools (April 2025)

Beyond Grants: Federal Funding for School Facilities Part 1 (May 2024)

Going Deeper on Tax Credits for Schools Part 2 (May 2024)

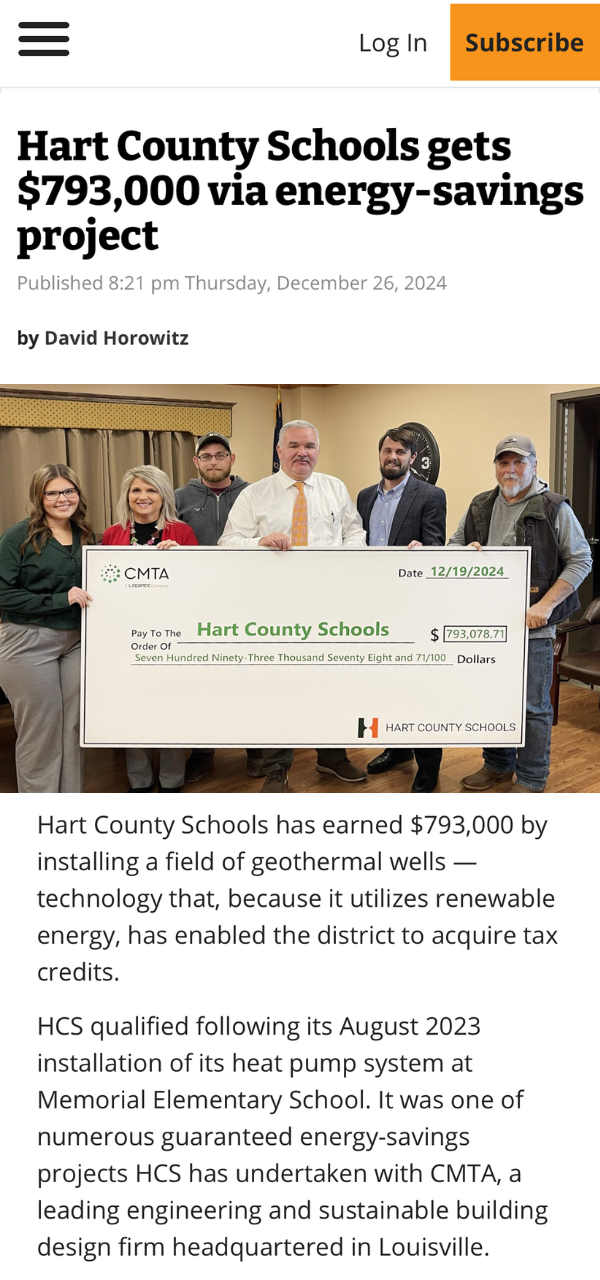

Read about school projects using energy tax credits and Elective Pay.

Check out federal resources

Fact Sheet

Toolkit

Template District Resolution to Explore Energy Tax Credits

This template resolution can be customized for your district and addresses the following areas:

Declarations about why this matters to students - whereas

Commitments by the school district - now therefore, be it resolved

Actions to get started - be it further resolved, pursuant to the foregoing commitments