Undaunted’s work across the country

We are working to catalyze K-12 climate action nationwide so that every student has the opportunity to attend a safe, healthy, and resilient school and is prepared to shape a sustainable future in a rapidly changing climate. Explore this map to see where we’re working, and view selected engagements, media, and other highlights of our work.

Seal of Climate Literacy

The Seal of Climate Literacy is a formal high school diploma endorsement that recognizes students with climate science, civic engagement, and problem-solving skills. Undaunted is working with Lyra, who first championed the Seal in Colorado, on a national campaign to support new states to adopt the seal and prepare young people with job-ready skills and tools to lead, work, and thrive.

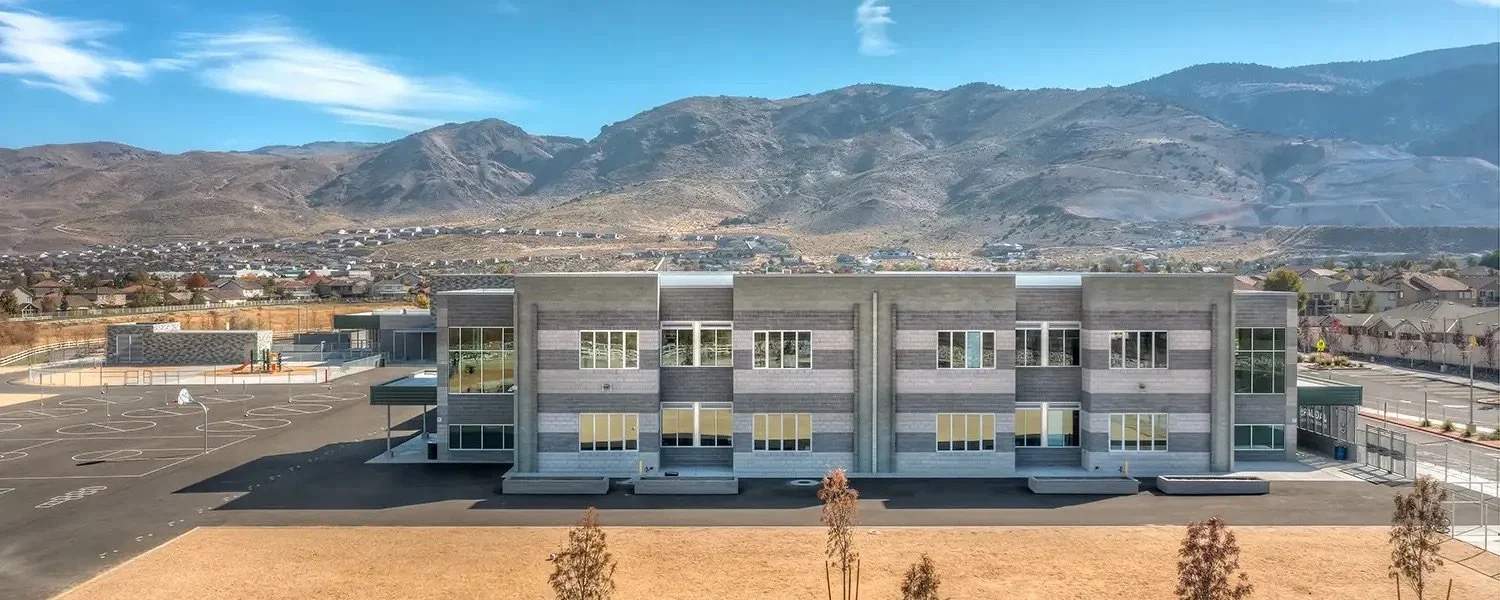

Modern HVAC in Schools

Ground-source heat pumps are a modern, cost-saving, clean alternative to legacy heating and cooling technology in schools. We are leading a national effort to support schools to replace outdated fossil-fuel burning equipment with this technology to achieve reliable heating and cooling, healthy indoor temperatures, and lower operating costs.